Ontario’s 2025 Budget, unveiled by Finance Minister Peter Bethlenfalvy, outlines sweeping investments aimed at fortifying the province’s economy, boosting job growth, supporting local industries—including the alcohol sector—and making life more affordable for residents. Titled A Plan to Protect Ontario, the budget not only addresses economic uncertainty caused by U.S. tariffs but also positions the province to become the most competitive place to do business in the G7.

Economic Resilience and Job Creation at the Core

The province plans to invest billions across multiple sectors to support workers, attract investment, and build long-term economic stability. This includes:

-

$500 million for a new Critical Minerals Processing Fund to develop Ontario’s mineral sector.

-

$1 billion over three years for the Skills Development Fund, bringing the total to $2.5 billion to help train workers in high-demand sectors.

-

An enhanced Ontario Made Manufacturing Investment Tax Credit, with a proposed rate increase from 10% to 15% for Canadian-controlled private corporations (CCPCs), and a temporary extension of eligibility to larger public companies.

-

A $5 billion Protecting Ontario Account, designed to support businesses impacted by tariffs and global economic disruptions.

-

$200 billion over 10 years in capital investments, including $61 billion for public transit, $56 billion for health infrastructure, $30 billion for schools and child care, and nearly $30 billion for highway projects.

-

Permanent cuts to gasoline and fuel taxes, saving households around $115 annually.

-

The permanent removal of tolls on Highway 407 East, potentially saving commuters up to $7,200 each year.

“These strategic investments protect Ontario jobs and industries while building the foundation for long-term growth,” said Minister Bethlenfalvy. “This is how we make Ontario stronger, more resilient, and globally competitive.”

Big Boosts for Ontario’s Alcohol Sector

The 2025 Budget also includes significant investments in Ontario’s wine, beer, and spirits industries—worth over $425 million—to modernize the alcohol marketplace and support local producers:

-

$175 million over five years to increase the percentage of Ontario-grown grapes used in blended wine, which is expected to double domestic grape purchases and benefit local farmers.

-

More than $250 million over two years to make the alcohol sector more competitive and consumer-friendly, including:

-

A reduced tax rate for spirits sold at on-site distillery retail stores.

-

A cut to the microbrewer basic tax, supporting small brewers across the province.

-

These initiatives follow Ontario’s recent steps to liberalize alcohol sales, including allowing wine, beer, cider, and ready-to-drink cocktails to be sold in more convenience and grocery stores. The government says these investments will make alcohol more affordable and support job creation in the hospitality and tourism industries.

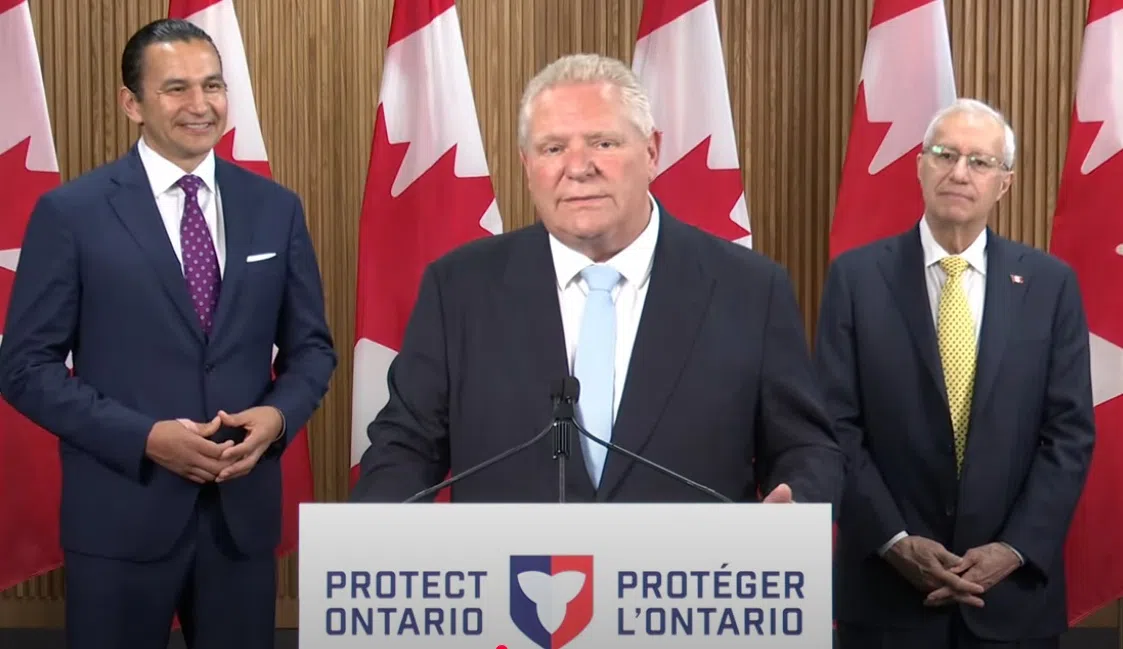

Ontario and Manitoba Sign Historic Trade Agreement

Furthering its vision for a seamless and competitive economy, Ontario Premier Doug Ford and Manitoba Premier Wab Kinew signed a memorandum of understanding (MOU) to enhance the movement of goods, services, and labour between the two provinces.

The agreement includes:

-

Eliminating interprovincial trade barriers, with both provinces committing to removing all exceptions under the Canadian Free Trade Agreement.

-

Expanding direct-to-consumer alcohol sales, set to be in place by the end of June 2025.

This is Ontario’s third such agreement, following similar deals with Nova Scotia and New Brunswick. The move is expected to benefit manufacturers, producers, and small businesses by opening new markets and simplifying regulatory compliance.

“This is about trust, opportunity, and building a stronger Canada through economic cooperation,” said Premier Kinew.

What It Means for Norfolk County and Beyond

For regions like Norfolk County, which are home to wineries, breweries, and skilled tradespeople, the 2025 Budget represents expanded opportunities and direct support:

-

Local grape farmers and vintners stand to benefit from increased provincial purchasing.

-

Trades and skilled labourers could see enhanced training options and more job sites as part of the $200 billion capital plan.

-

Small businesses affected by tariffs or looking to grow across provincial borders may be eligible for funding and expanded market access.

Ontario residents and businesses are encouraged to explore programs and updates via Ontario.ca as details are released.